Tesla Sales Take A Dip Such As 63% In Germany, Whilst BEV Sales Surges By 37%

Tesla is struggling to sell their models in the European market. However, the reason is multi-faceted as opposed to the buyers not wanting EVs. This is because EV sales have grown by 37%. Let’s find out the reason behind the American Brand’s failure to capture the European markets in recent times.

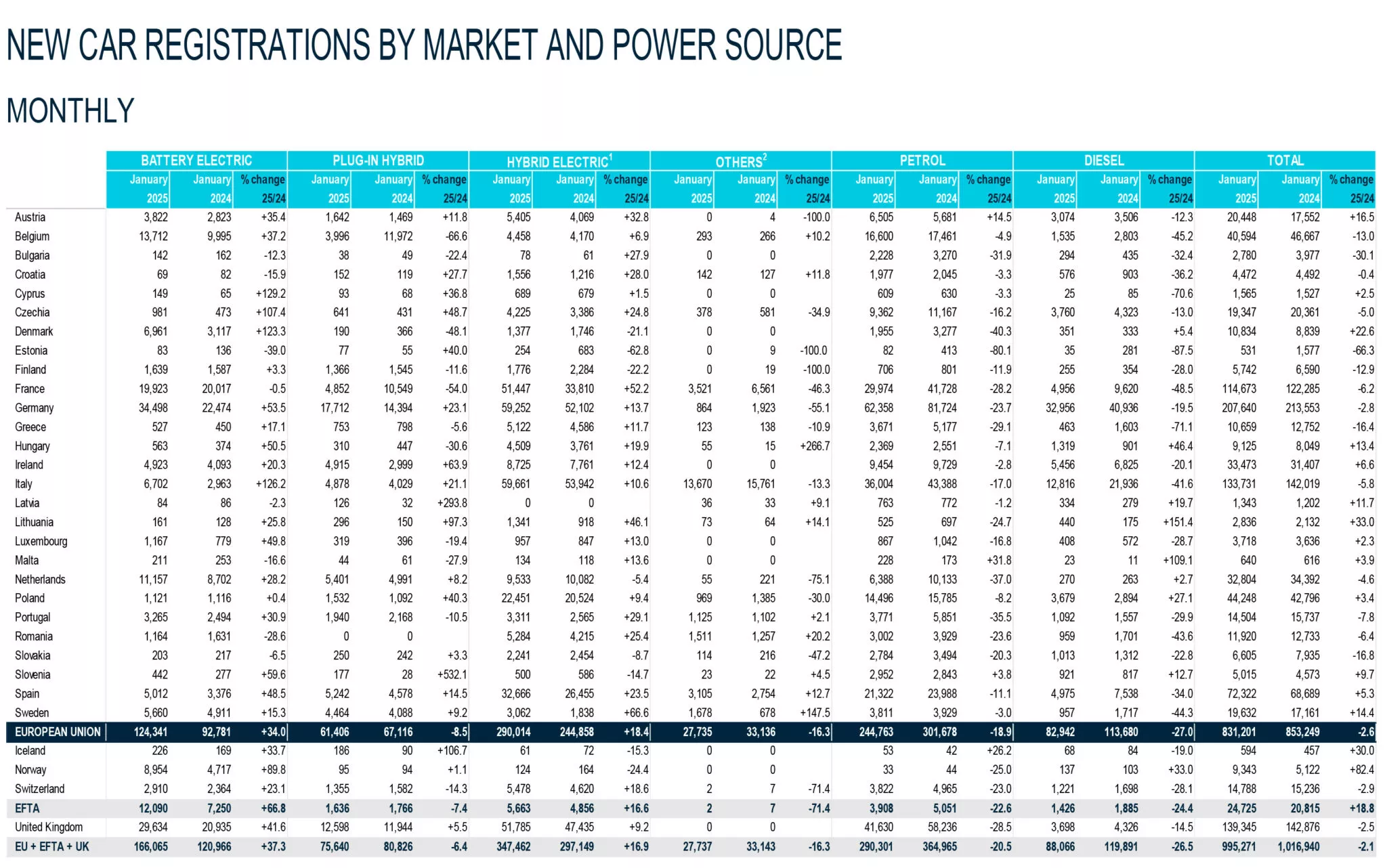

Statistics

The sales of the models carrying the Tesla badge have plummeted by 50.2% in Europe and 45.2% in the combined EU, EFTA (Iceland, Norway and Switzerland) and UK markets in January 2025 as compared to the same month last year. The most interesting aspect of this stunted growth is when you compare it to other EVs which have surged by 37%.

Sales Drop: January 2025 Vs January 2024

According to European Automobiles Manufacturers’ Association (ACEA), Tesla sold 9945 units in January 2025 which is down from 18,161 units sold in January 2024. This drop was the most noticeable in Germany where sales fell by 59.5% and France where the drop was a staggering 63% decrease to just 1143 units.

This was poorer than SAIC Motors which managed to sell more than double the cars in January 2025, with 22,994 units.

Political Factors At Play

There are several factors at play. One of the major factors could be the negative impression the company’s founder, Elon Musk, may have created by getting controversies such as the infamous nazi salute and outspoken political views that have stirred debate. This may have negatively impacted the Tesla models as a result.

The brand perception may also be tampered with as a result of Musk’s support for Germany’s AfD party, a political party with far-right views, and a jailed activist in the UK.

Production Delays

The timing of the Model Y update may also be a reason for the dip in sales as buyers may be waiting for the new Model Y which brings significant changes to the crossover. Tesla has also had to retool the production lines for the Model Y which has caused delays.

In addition, general inventory delays are also a factor to consider as the American brand is dealing with low stock levels in 2025 due to the push in sales for the end of last year.

Growth Surge For BEVs

The overall demand for Battery Electric Vehicles has shown a surge with ACEA reports suggesting 1,24,341 EVs sold in the EU and 1,66,065 in EU+EFTA+UK. This suggests a healthy market share of 16.7% which is an increase from 11.9% in January 2024.

However, the sales have dropped for market shares of diesel (8.8%) and PHEVs (7.6%). Interestingly, the region’s favourite powertrain is HEVs (self-charging hybrids) which have a 34.9% market share, followed by gasoline (29.2%).

It is important to note that new car registrations have also experienced a dip of 2.6% in the EU because of declining sales in crucial markets such as France (6.2%), Italy (5.8%), and Germany (2.8%).

Outlook

This sales plunge seems can be a result of competent offerings which are affordable and offer better fit and finish levels compared to Tesla. This is also a time for the company’s founder, Elon Musk, to re-evaluate his publicity and think twice before speaking about something that can negatively impact one of the pioneers of Electric Vehicles.