Tata Group companies have quietly joined Tesla’s global supply chain

Several Tata Group companies have quietly cemented their positions as global suppliers to Tesla, as the American electric vehicle giant intensifies its engagement with India’s burgeoning EV ecosystem. According to industry insiders, Tata AutoComp Systems, Tata Consultancy Services (TCS), Tata Technologies and Tata Electronics have all secured supply roles with Tesla, contributing to the estimated $2 billion worth of components sourced from Indian firms in the financial year 2024.

While Tesla has not yet confirmed plans to manufacture in India, its procurement teams have been in active discussions with both current and potential suppliers about future collaboration. These talks have included conversations about the establishment of local facilities near Tesla’s future manufacturing hubs, should the company enter the Indian production landscape.

“Tesla appears to be strategically preparing the ground for an eventual local supply chain in India,” said a senior industry official familiar with the matter, speaking on condition of anonymity. The company is reportedly exploring partnerships across a range of components—castings, forgings, electronics, and fabricated parts among them.

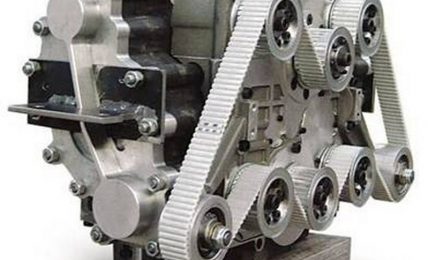

At present, India primarily serves as a development and export hub for Tesla’s global operations. However, sources suggest Tesla is looking to diversify its sourcing away from China and Taiwan, particularly for components such as wiring harnesses, electric motors, gearboxes, precision-forged parts, suspension systems, powertrains and complex electronic assemblies.

Within the Tata Group, each company contributes a unique capability to Tesla’s global supply chain. Tata AutoComp specializes in EV-specific engineered components; Tata Technologies provides end-to-end product lifecycle solutions; TCS offers circuit board design and related tech services; and Tata Electronics is expected to deliver semiconductor components once its production facilities are operational.

Industry analysts believe these supply ties position the Tata Group for greater opportunities, particularly if Tesla proceeds with plans to set up manufacturing in India. The company’s final decision may hinge on India’s policy landscape, including the availability of tax incentives and import duty exemptions.

Tesla is also said to have engaged other Indian suppliers such as Bharat Forge, Sona BLW Precision Forgings, Suprajit Engineering, Varroc Engineering, Samvardhana Motherson and Sandhar Technologies for critical vehicle parts. Together, Indian companies are estimated to have contributed between $1.7 and $1.9 billion worth of components to Tesla in FY24, a figure that continues to grow in the current fiscal year.

Following global supply disruptions during the COVID-19 pandemic, Tesla has been actively working to reduce its dependence on Chinese suppliers by diversifying its sourcing footprint. As part of this effort, it has urged partners supplying markets outside China to shift production outside China and Taiwan by next year.

In parallel, Tesla is reportedly in talks with several Indian states—Rajasthan, Gujarat, Maharashtra, Tamil Nadu and Telangana—regarding the potential setup of manufacturing operations. While no formal announcement has been made, such a move would significantly enhance Tesla’s presence in India and create expanded opportunities for the country’s supplier base.

Despite Tesla’s characteristic silence on supplier relationships due to confidentiality agreements, industry signals point to India playing an increasingly critical role in the company’s global strategy—both as a supplier and potentially as a manufacturing base in the near future.

Source