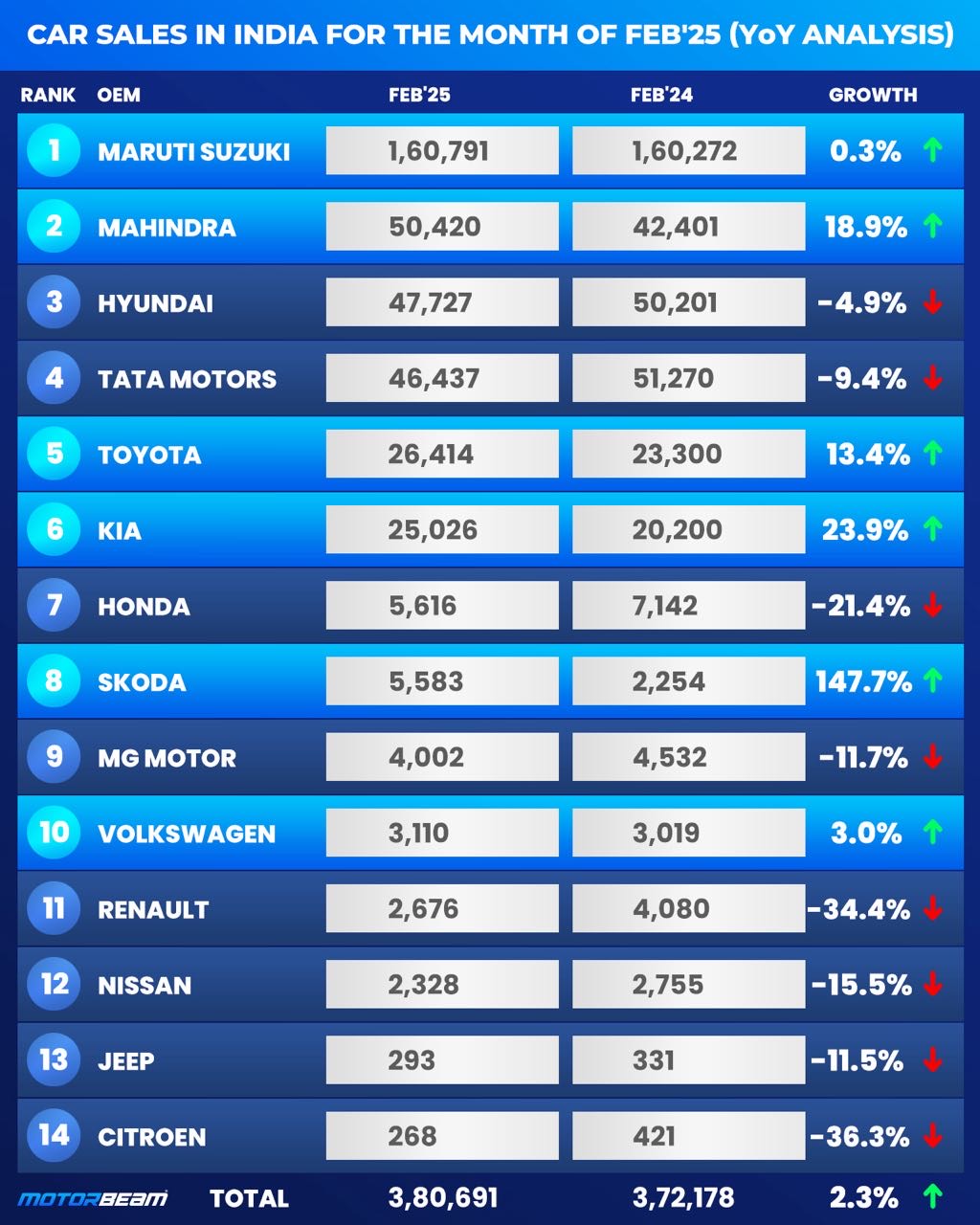

Mahindra overtakes Hyundai to become India’s second-largest carmaker in February

India’s passenger vehicle market saw sales of approximately 3.8 lakh units in February 2025, reflecting a modest year-on-year growth of 2.3% compared to February 2024. However, sales volumes declined by 5.2% compared to January 2025, indicating a slower start to the year.

The early months of a calendar year typically experience sluggish dispatches, as dealerships focus on clearing leftover stock from the previous year. This year, price hikes on new models and a reduction in promotional offers further dampened buying sentiment. Additionally, economic uncertainty has impacted consumer spending on big-ticket discretionary purchases, including cars.

Mahindra Overtakes Hyundai

A major development in February 2025 was Mahindra surpassing Hyundai to claim the second position in India’s passenger car sales rankings. This reshuffle highlights the intensifying battle for the No. 2 spot, with Mahindra, Hyundai and Tata Motors locked in close competition month after month.

Mahindra’s robust performance can be attributed to the ongoing success of the Thar Roxx and the positive reception of its newly launched electric vehicles – the BE 6 and XEV 9. An interesting trend within Mahindra’s portfolio is the exceptional performance of the Thar, which outsold more affordable and mainstream models like the Bolero, XUV 3XO and XUV 700.

Skoda Surges Ahead

Among the brands that posted positive year-on-year growth in February 2025, Skoda stood out by not only improving on its February 2024 sales but also increasing volumes over January 2025.

The Skoda Kylaq has quickly become the brand’s best-selling model, propelling the automaker ahead of MG in the monthly rankings. Skoda now ranks just behind Honda, marking a significant climb for the brand in the Indian market.

Maruti Suzuki Maintains Lead

Maruti Suzuki, India’s largest car manufacturer, recorded flat growth in February 2025, with 1,60,791 units sold, compared to 1,60,272 units in February 2024. Despite holding onto its top position, Maruti experienced a 0.8% drop in market share, signalling rising competition from both traditional and emerging rivals.

Hyundai and Tata Face Pressure

Hyundai, which has historically held the No. 2 position in the Indian car market, saw its rank slip to third place as Mahindra took the second spot in February 2025. Hyundai dispatched 47,727 units, registering a 4.9% decline compared to February 2024. With no major new product launches, Hyundai relied on existing models to drive sales, limiting its growth potential.

Tata Motors, which has been a consistent player in the top three, also reported a 4.92% year-on-year sales decline, with 47,727 units sold in February 2025. Tata’s performance indicates softening demand, particularly in the wake of increased competition from Mahindra’s new EVs and SUV lineup.

Kia Closes Gap with Toyota

Kia Motors emerged as a standout performer, recording an impressive 24% year-on-year increase in sales, thanks in part to the strong performance of the newly launched Syros.

With Kia now trailing Toyota by just 1400 units, the competition for the fifth spot in the sales rankings is heating up, setting the stage for an exciting rivalry in the months ahead.

What Lies Ahead?

As 2025 progresses, the Indian automotive sector is expected to navigate a mix of economic pressures, evolving consumer preferences, and intensifying competition. With the rapid growth of electric vehicles (EVs) and new model launches expected from key players, the competitive landscape is likely to remain dynamic.

Brands like Mahindra, Hyundai, Tata Motors and Kia will continue to battle for market share, while Maruti Suzuki will work to defend its leadership amidst growing competition. Buyers can expect more product innovations, feature upgrades and competitive pricing strategies, making the coming months crucial for India’s auto industry.