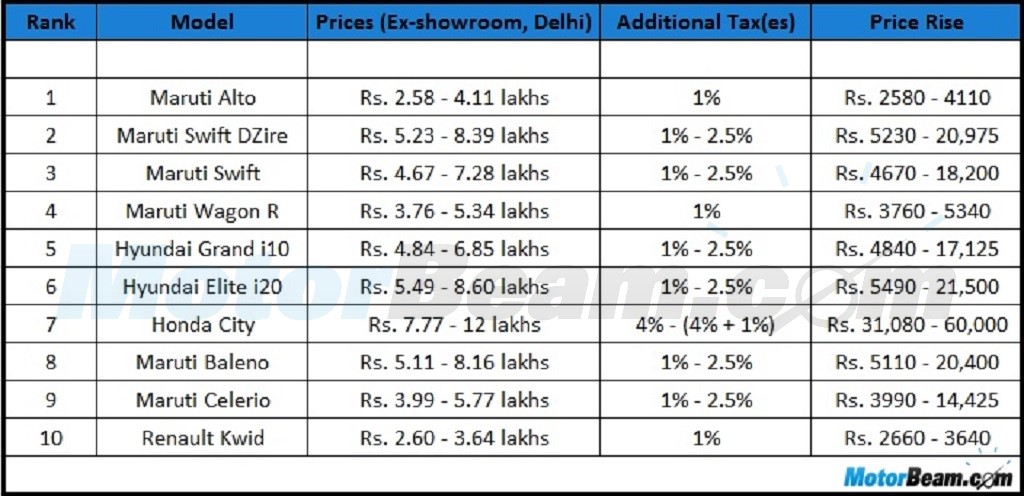

The Union Budget 2016-17 carries a tax hike for cars of various segments. We take a look at the impact of taxes on prices on the top ten selling cars in India.

Every year, the Finance Minister of India presents the Union Budget. And every year, automotive companies hope that there is some relief given to them in the form of reduced taxes or at least no increase. But, since cars are treated as a luxury item in a developing country like India, they are taxed heavily.

This year too, the taxes have been increased on all cars be it entry-level hatchbacks or brawny SUVs. The major reason for addition of new taxes is the rising level of pollution and congestion. The increase in prices have historically proven to a deterrent for car sales and it is expected to do the same this time too.

New Taxes On Cars

– 1% infrastructure cess on all petrol, CNG and LPG cars with length under 4-metres and engines smaller than 1200cc

– 2.5% infrastructure cess on all diesel cars with length under 4-metres and engines smaller than 1500cc

– 4% infrastructure cess on all cars not included in the above mentioned categories

– 1% additional tax on all cars costing more than Rs. 10 lakhs (ex-showroom)

The above changes will increase the prices of cars by a substantial margin. While affordable cars like the Maruti Alto and Renault Kwid see a slight increase in price, C-segment sedan Honda City sees a price increase of upto Rs. 60,000/-. Price rise in case of more expensive cars is even more substantial and exceeds Rs. 1 lakh for vehicles costing above Rs. 20 lakhs.

Considering these price hikes are on ex-showroom prices, the on-road price difference will be even higher depending on the road tax in the particular state. Although this will prove to be a deterrent for car sales, the improving economic condition due to other schemes in the budget might give a boost to the automotive industry covering the dip in sales.