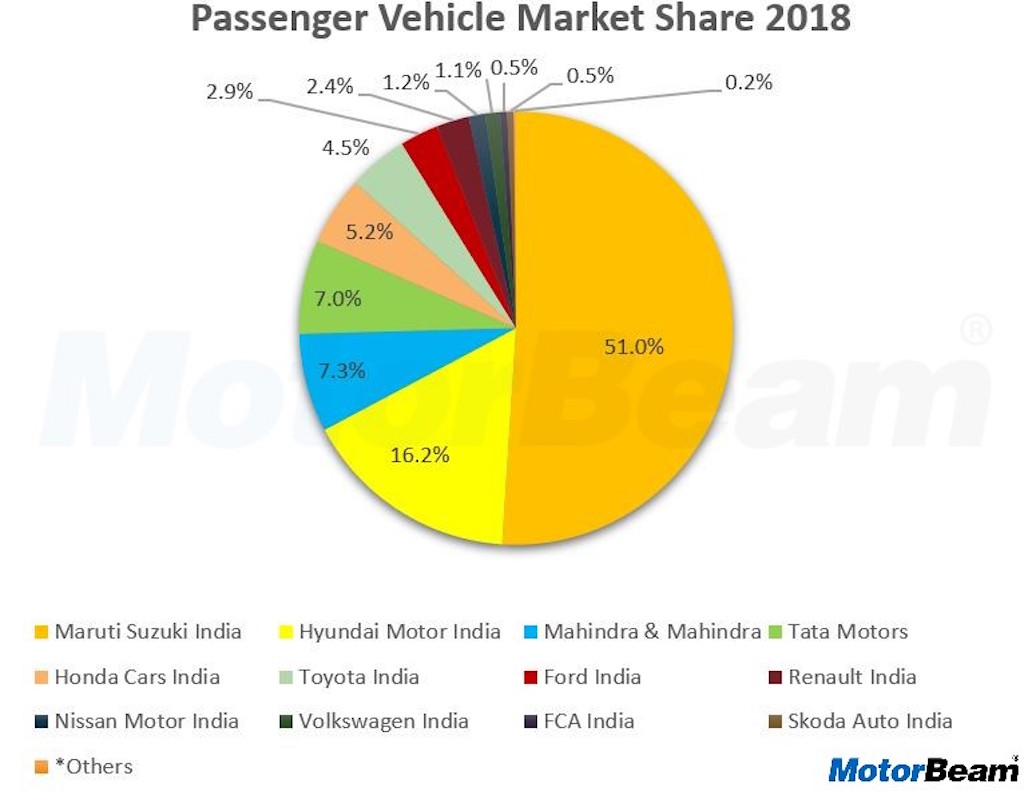

Top 4 carmakers Maruti, Hyundai, Mahindra and Mahindra, and Tata accounted for over 82 percent of the Indian car market.

The year 2018 started with a high note on the back of excitement around the 2018 Auto Expo and several new launches. But the euphoria eventually faded away in the latter part of the year due to an uneven monsoon, Kerala floods, poor festive demand, and fluctuating fuel and insurance costs.

The first half of the calendar year witnessed important launches such as the Maruti Swift, Honda Amaze and Hyundai Elite i20 facelift which contributed heavily to the growth of the passenger vehicle market. Rajan Wadhera, President, SIAM said that the overall year was challenging as the festive sales were short of the expectations because of several reasons like high fuel prices, non-availability of credit and the overall sentiments did not pull the customers to the showroom.

Passenger vehicle sales recorded single-digit growth of 5.32 percent at 33,93,705 units when compared to 32,22,220 units in the calendar year 2017. The sales started to weaken after the devastating floods in Kerala, which is the largest market for passenger vehicles followed by Maharashtra. This is was further dampened by high insurance cost, liquidity crunch, and increasing fuel prices.

In the period between June and October, the prices of petrol and diesel notched up by 14 percent and 17 percent respectively, according to the Petroleum Planning and Analysis Cell. This further led to dwindling festive season sales which ended early November with Diwali. During the 42-day long festive period, the retail sales of passenger vehicle were down by 14 percent, as per a report by the Federation of Automobile Dealers Association (FADA). The festive season is considered an important sales period for automakers as about 30 percent of annual car sales happen during this period.

Sridhar V, Partner, Grant Thornton India LLP said that the auto sector had witnessed the lowest quarterly performance across all the segments and lowest monthly sales till then in FY19. He also explained that the year-on-year growth for FY19 had shown a growth of 9.6 percent. He further added that year-end discounts helped to gain some recovery. He hoped that stable fuel prices can improve the sentiments in the first quarter of 2019.

But the market sentiment seems to affect the few carmakers as 7 out of 16 carmakers posted positive growth. Out of which, top four carmakers mainly Maruti Suzuki, Hyundai India, Mahindra & Mahindra, and Tata Motors accounted for over 82 percent of the Indian passenger vehicle market. Among all, the largest gainer was Tata Motors which posted 24.13 percent growth at 2,37,217 units in the calendar year 2018 recording a market share of 7 percent from earlier 5.9 percent in 2017 riding on the success of the Nexon and the Tiago.

While the largest passenger vehicle manufacturer continued to be Maruti Suzuki which recorded the sales of 8.05 percent at 17,31,450 units recording 51 percent market share in the calendar year 2018. Similarly, Ford and Toyota witnessed growths of 10.91 percent and 8.54 percent respectively. However, the South Korean carmaker Hyundai India which launched its much-awaited hatchback Santro witnessed a slow growth of 4.30 percent at 5,50,002 units in 2018. It also saw a decline of 0.2 percent in market share to 16.2 percent.

On another hand, Japanese carmaker Honda which started a high note on the robust sales of Amaze saw a decline of 2.18 percent. While the luxury car market consisting of Mercedes-Benz, BMW, Audi, Jaguar Land Rover and Volvo stood at 40,340 units, a growth of 3.4 percent. Mercedes-Benz ranked at the top again with 38.5 percent market share followed by BMW which had 27.5 percent in market share in 2018. Mercedes-Benz witnessed a minor decline of about one percent in the market share while BMW gained market share by 2 percent. Even the luxury segment saw an overall decline of 3.30 percent at 37,702 when compared to 38,989 in 2017.

Car Manufacturer Sales 2018

– Car sales in 2018 were on a decline owing to various reasons

– Maruti Suzuki remained India’s biggest car maker while Mercedes-Benz was ranked first in the luxury segment

– Tata Motors saw a great rise in overall sales

Source – ETAuto.com