If anyone of you ever had a chance to hear Mr. Rajiv Bajaj, then you might have heard him boasting about Bajaj Auto being the only Indian two-wheeler manufacturer to have a 20% EBITDA. Now once again he has the reason to do so, because Bajaj Auto managed to end its first quarter of the financial year with 21.6% EBITDA. The company has a cash surplus of over Rs. 7000 crores.

What is EBITDA? It’s an acronym for Earnings Before Interests, Tax, Depreciation and Amortization. In our simple petrolhead language, it’s the money the company got by selling their bikes minus the money company spent to build them, excluding all other financial components. By this moment you might have checked if you have navigated correctly to MotorBeam or to some business website. But yes, you are reading this financial report card of Bajaj Auto here, because the report has some interesting facts hidden in it. Let’s find out

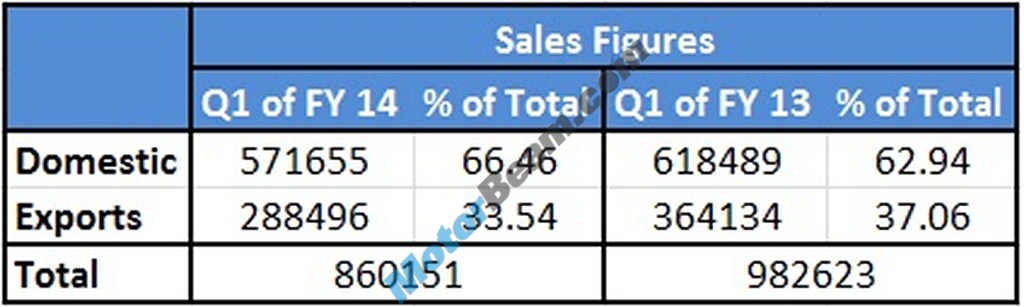

All about number 2 rank – As we all know, since ages Hero MotoCorp is dominating the number one position in the Indian two-wheeler market and all the activity happening is at number two. Bajaj Auto secured the second place, by selling 8,60,151 units in this quarter, if we consider overall sales number of the company. But if we zero down to only domestic market, then Honda is way ahead of them as they sold 7,40,6801 units against Bajaj Auto’s 5,71,655 units. If we compare domestic bike sales only then Bajaj Auto is comfortably ahead of Honda which sold only 335,162 units. So from which vantage point you see this situation will decide the number two contender of the Indian two-wheeler industry.

Sales numbers are down, but profit is not – The company sold 8,60,151 units in this quarter considering domestic and export sales, which is less by around 1.3 lakh units compared to sales numbers in the same period last year. The domestic two-wheeler industry itself has shrunk in volume since the last few months and export markets are having their own issues. According to the company, the premium two-wheeler market, where Bajaj Auto has a market share of around 46%, has shrunk by 11%. That has had a big impact on the company’s domestic performance. Also the strike at their Chakan plant gave the company a set back of around 20,000 units. But surprisingly the profits and turnover figures have increased, thanks to Rupee depreciation. As we all know, Bajaj Auto’s large chunk of sales come from the export market and hence it brings in the dollars for them. So the company enjoys the benefit of depending on exports.

Benefits of exports – When Mr. Rajiv Bajaj took hold of the throttle of the company, he started focussing on export markets. The actions have been taken accordingly since then and today Bajaj Auto is exporting around 1/3rd of their total production to countries like Egypt, Sri Lanka, Indonesia and some European countries. Thus when domestic market is falling along with Rupee against USD, the export market acted as a saviour for the company. One thing to notice is that there is a decline in sales in those export markets too, because of local issues like political unrest, change in rules and regulations, etc.