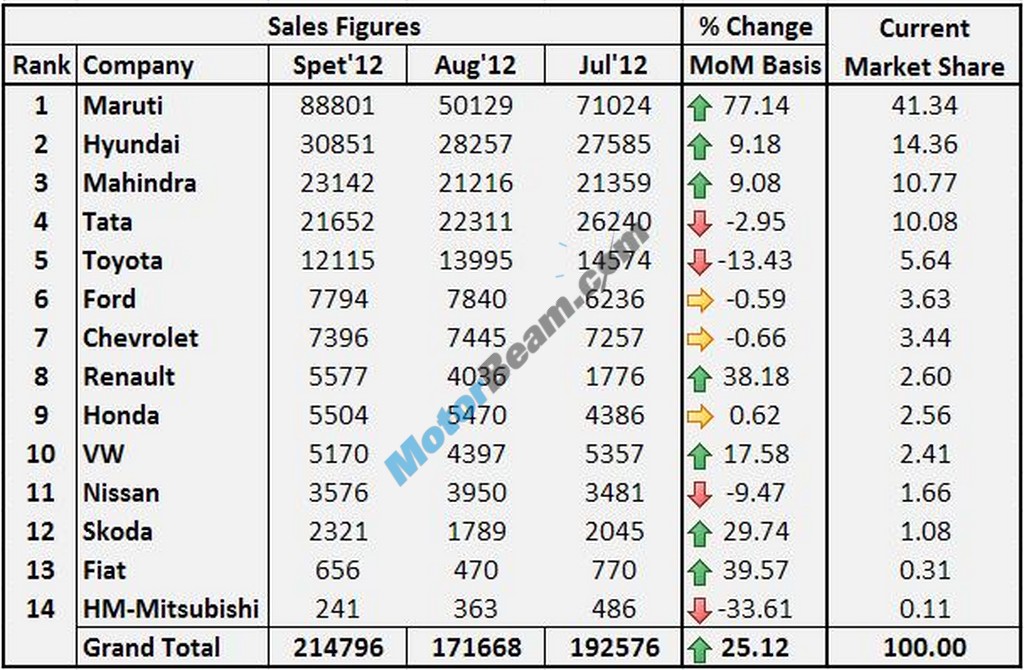

The Big Picture – A fresh breeze of festive season has brought life back into the car market of India. After three consecutive months of slowdown in sales, industry has crossed 2 lakhs mark once again. As we know, apart from the festive season, few other things propelled this month’s sales, first being Maruti Suzuki’s quick and strong comeback, then being the rise in demand for petrol-powered cars and lastly the new launches. Even with partial production at Manesar, Maruti Suzuki managed to sell 88,801 cars showing 77.14% growth which propelled the whole market up and thus it held the numero Uno position.

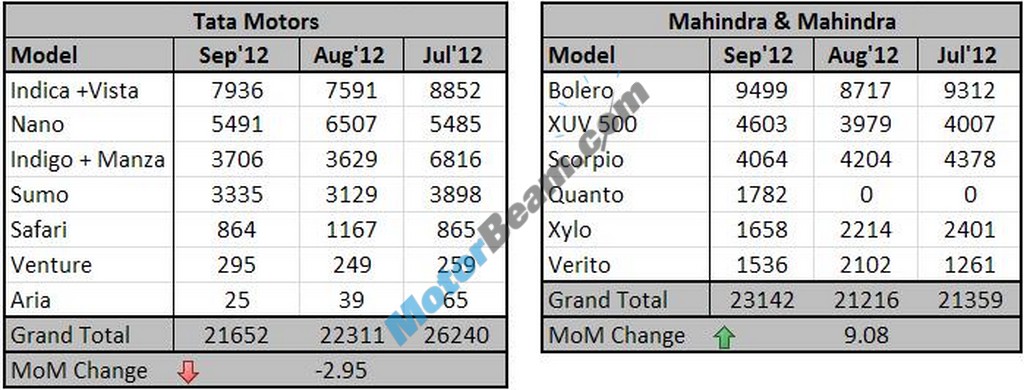

Availability of CNG option turned the fate of i10 hatch and in turn that of Hyundai, which held number 2 position by showing 9.18% rise. Consistency in growing sales once again took Mahindra ahead of Tata in September, as Mahindra recorded a 9% growth while Tata Motors recorded a decline in the sales leaving them at number 3 and 4 spot respectively. Other than Toyota and Nissan, no one has recorded a major decline in sales and that is why the market grew by 25.12% overall. If we see, there is a strong demand for petrol-only powered cars this month which might be the result of the availability of the CNG-LPG variant or increased diesel prices, which shifted the balance back to petrol’s side. We will see detailed analysis of each company under the ‘Company wise breakup’ section.

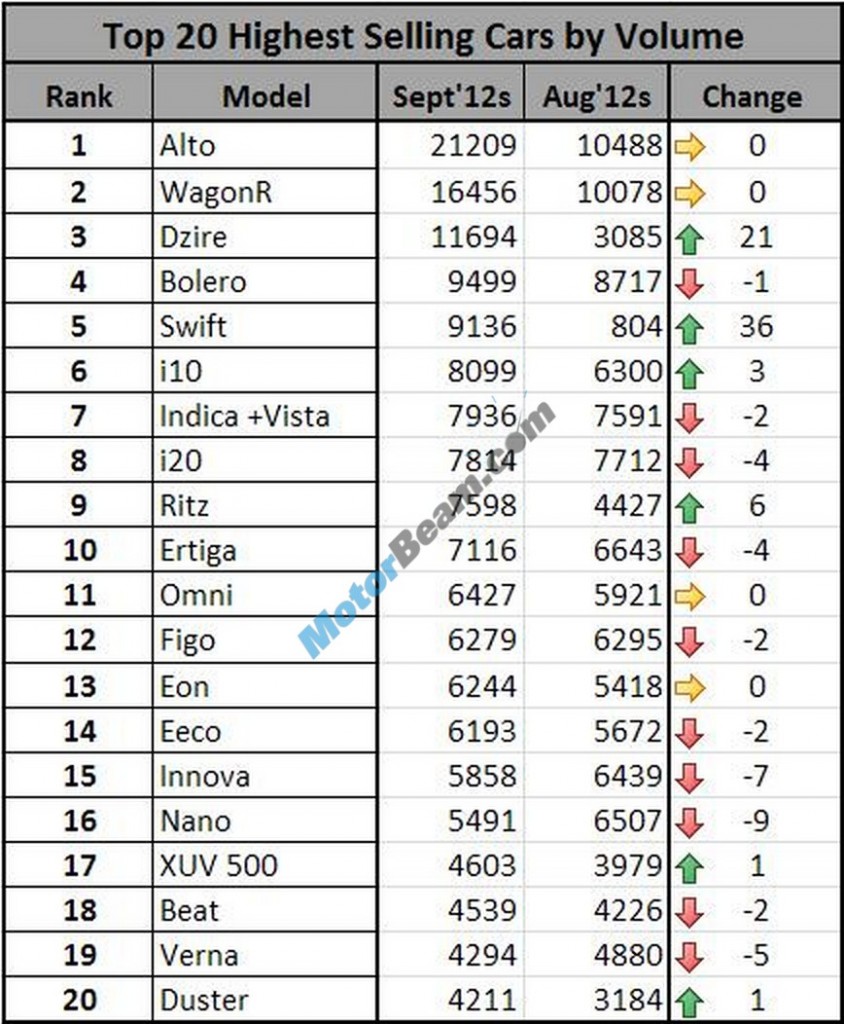

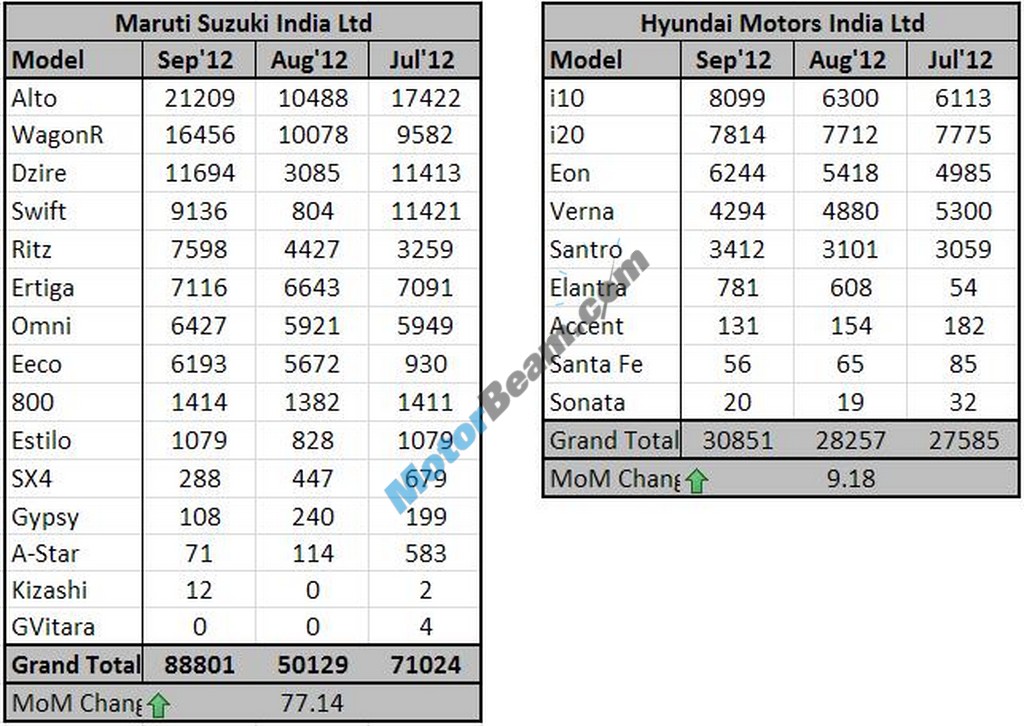

Top 20 Chart – The Top-20 chart below, appears like a report card of Maruti’s comeback, this month. There are 4 Marutis in the top-5 highest selling cars. Alto’s volume has doubled over the last month and similarly WagonR also registered a strong growth. Surprisingly, both cars are available as petrol only models with CNG-LPG as an optional fuel. Then there are Swift twins which recovered from tragedy very quickly. Dzire took 3rd spot by selling 11,694 units and Swift hatch took 5th spot by selling 9,136 units. In between them, there is Mahindra Bolero at number 4 which is constantly selling over 9,000 mark. If Mahindra claims themselves as Maruti of SUV segment, then we can name Bolero as Alto of SUV segment.

Hyundai’s i10 has crossed 8,000 mark and has shown such a growth first time in this financial year, which takes it to number 6 spot. Facelift of Ritz has lifted the graph of sales too taking it back in Top-10. Interestingly, Duster has entered top-20 chart – a first time moment for any Renault branded car in India. Overall, recovery of Maruti’s sales has made many others to lose their position and hence we are seeing many red arrows in chart despite the situation being healthy indeed.

Company Wise Break-Up – WagonR, Ertiga, Eeco and Ritz are the star performers of the month for Maruti, as they have shown their best performance since January’12. Hence they have been a major driving force behind 77.14% rise of overall Maruti sales. Further, the picture seems more promising for Maruti in the coming 3-4 months as Swift twins will reach their full capacity and Alto 800 will hit the shelves soon. Hyundai will be happier this month as their i10 has ended up topping the sales chart ahead of i20, with 8,099 units sold in September. Eon also managed to clock respectable 6,244 units this month. For Hyundai, one more thing to rejoice would be that Elantra took away the crown of highest selling D segment sedan from Corolla, 2nd time in a row. Overall Hyundai managed 9.18% growth and secured second position.

Once again at fourth place, Tata Motors is still facing path full of ups and downs as it is left behind by Mahindra. Tata motors registered slight decline of 2.95% in sales when Mahindra registered strong rise of 9.08%. Major rise in sales for Mahindra came from Quanto, Bolero and XUV500. Remarkable thing here is that XUV 500 overtook its cheaper sibling Scorpio by a good margin which points out the need for a all new Scorpio.

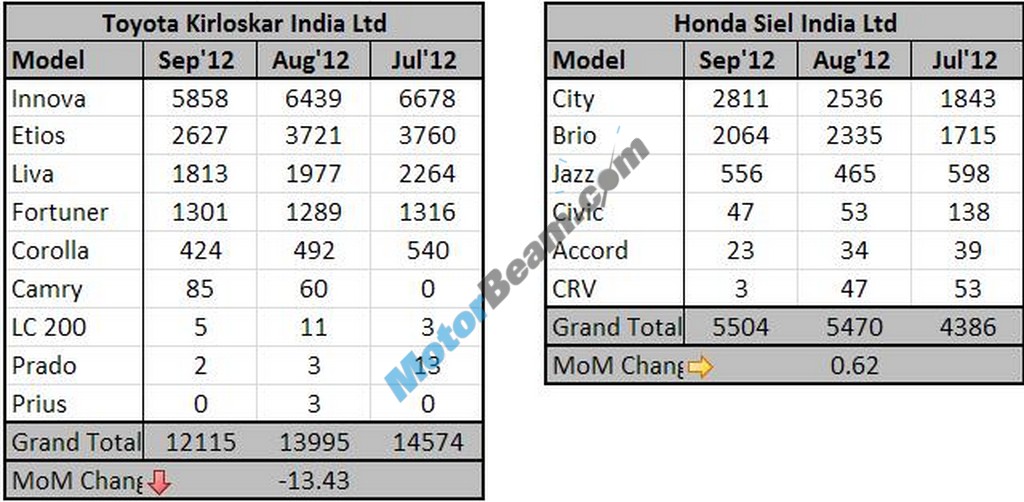

One of the strongest losers of this month is Toyota, as its sales fell down by 13.43%. All models in its portfolio have recorded lowest ever sales in the year 2012 except for Fortuner and Camry. On the other side, another Japanese manufacturer, Honda, is being left behind by new comer Renault. But still performance of Honda is respectable and is set to grow soon with the launch of City in CNG guise and Brio AT. Overall the month of September has shown no change for Honda. Toyota ended 5th in chart and Honda managed 9th position in September.

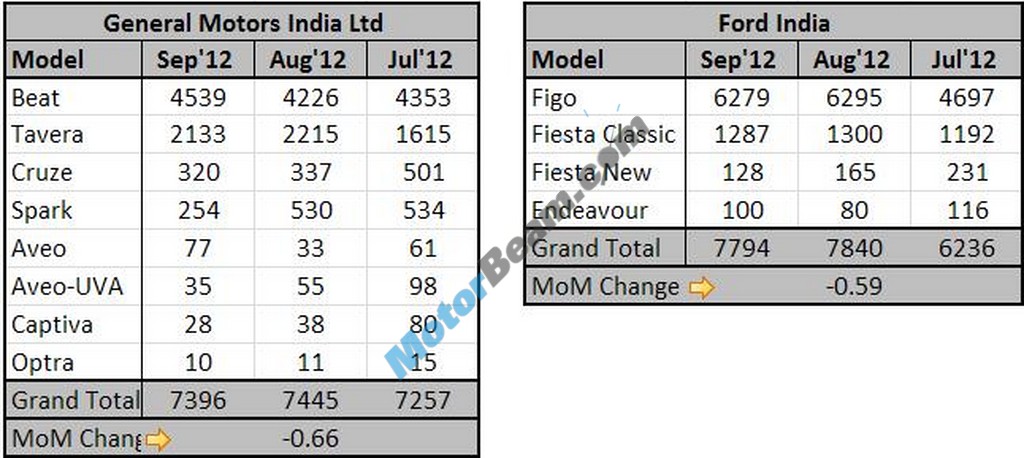

At number 6 and 7, there are Ford and Chevrolet respectively with no significant change in sales for both. Both companies have shown average performance this month. For this festival season, Chevrolet has big plans with 2 big launches lined up while Ford has just one mild facelift of Figo on offer.

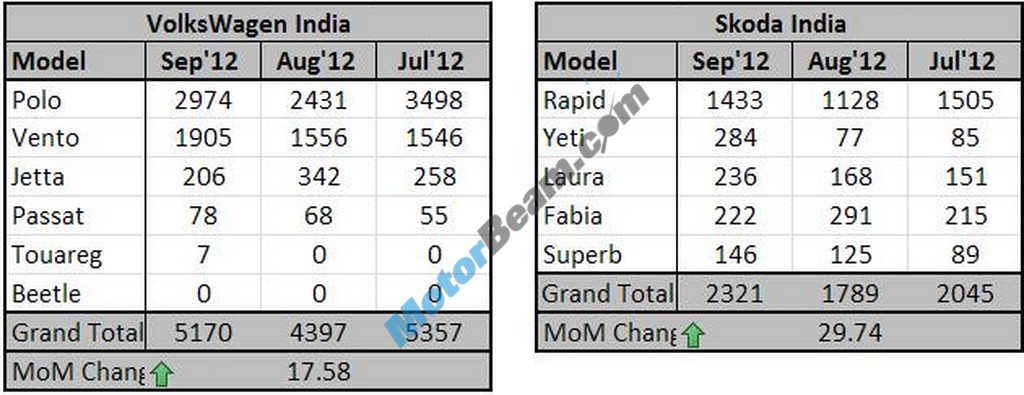

Volkswagen and Skoda have gained around 600-700 numbers which in turn scaled out 17.58% and 29.74% growth in sales respectively. Value added variants of Polo and Vento made the sales figures to go up for Volkswagen. And for Skoda, Rapid and Yeti gained volumes while Fabia is still lagging way behind its competition. VW stood at number 10 and Skoda at 12.

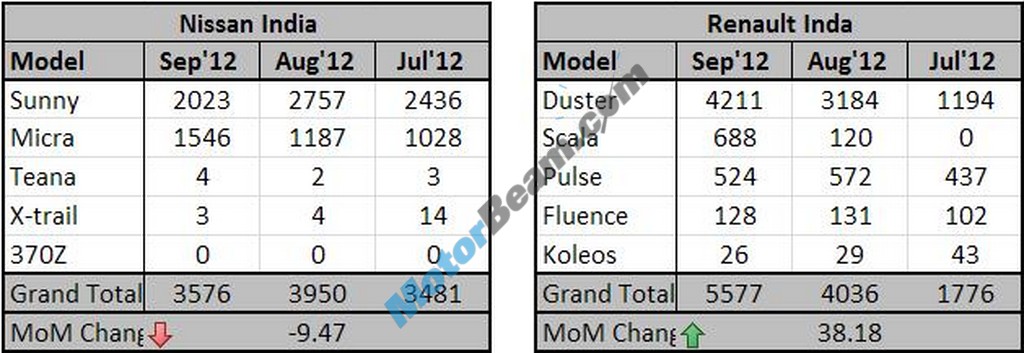

Renault and Nissan have been news makers of recent times. After the launch of Duster, Renault always ended up with huge growth in sales, this trend continued in September as well. Duster has crossed 4000 units’ sales mark and thus giving Renault India a growth of 38.18%. Sadly, Nissan has failed to come out with some positive results in this month but is expecting rise in volumes as Evalia is in market now. Scala effect has made dent in Sunny’s sale marginally, which resulted in 9.47% fall in sales for Nissan this time. Renault climbed up the chart to 8th spot while Nissan is enjoying its place at the 11th spot.

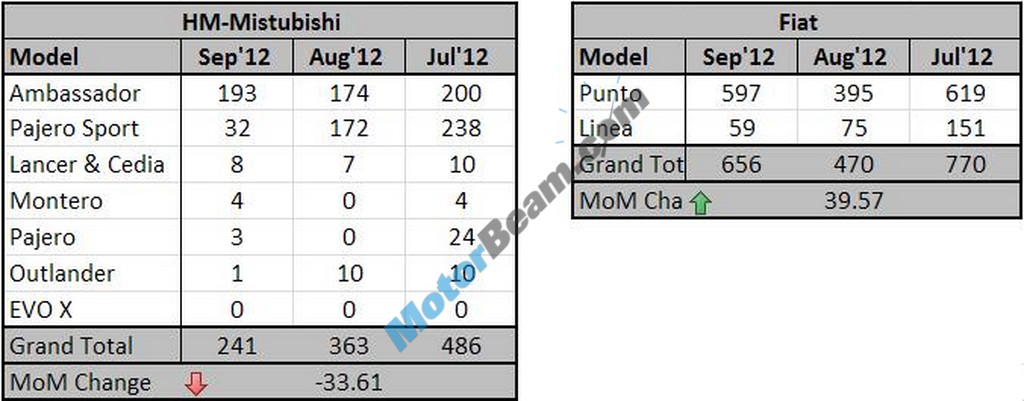

For HM and Fiat, change in sales by around 50 units results in huge percentage change in their sales chart. As their total sales volume itself is very small. Absolute edition of both Fiats has triggered a rise of 39.57% for Fiat. And drastic drop in Pajero Sport sale is the major factor which affected HM-Mitsubishi sales adversely.

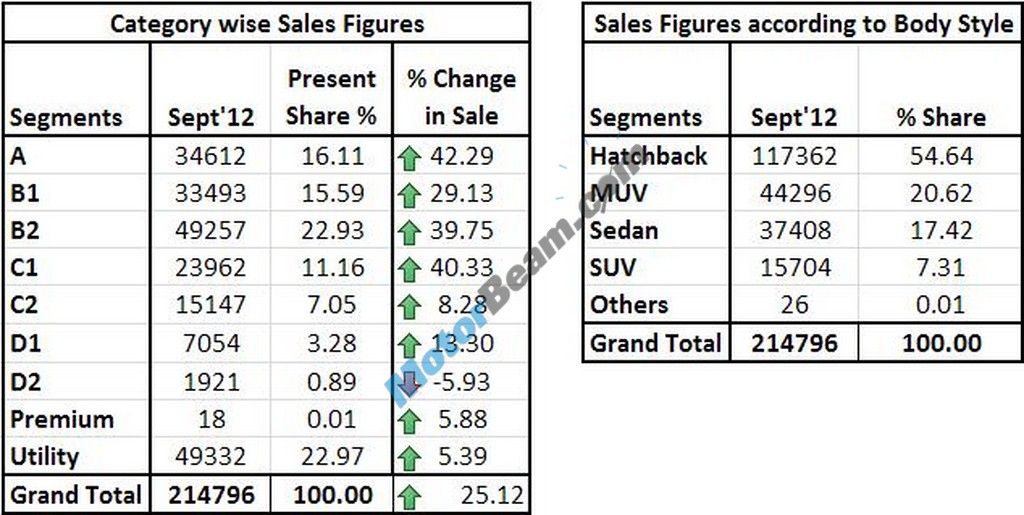

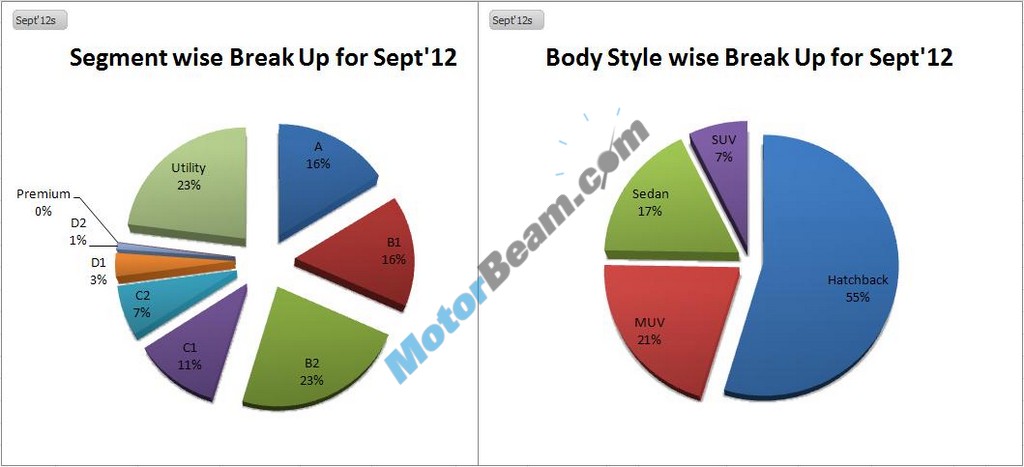

Category Wise Breakup – The category wise breakup has always been reflecting trend of Indian buyers. This time except bigger sedans, every category has grown in numbers. As usual UVs once again overtook sedans by big margin.

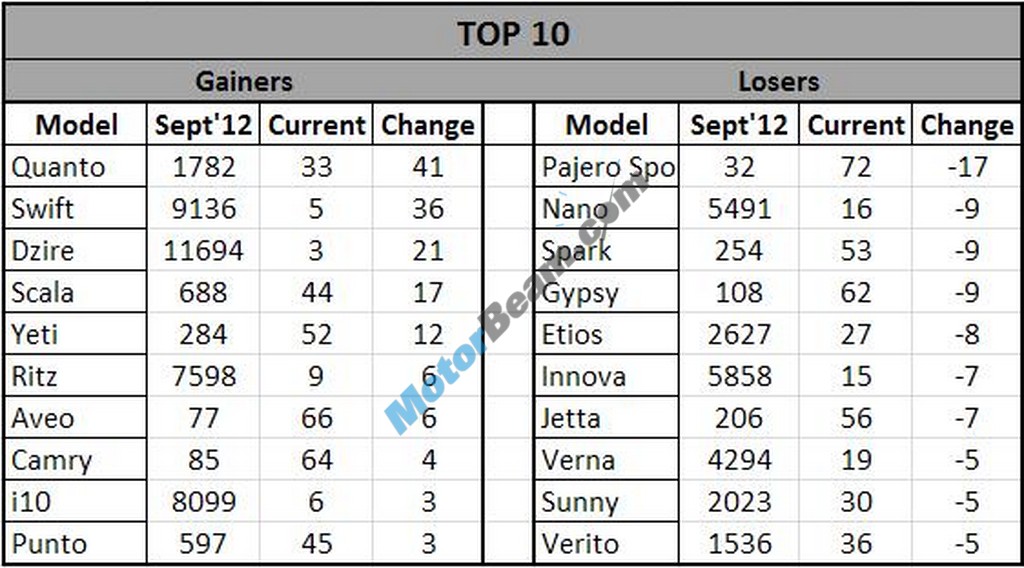

Gainers Vs Losers –

Podium Finishers –

Things To Look For In October –

– Festive season coming up.

– Special editions of many cars are already out and many more coming soon.

– Car makers are targeting this festive season so as to recover the losses of previous months.

– Tata Safari Storme to be launched in this month.

– Alto 800 expected in this month.

– Facelift of Spark is about to launch in this month.

– Chevrolet might launch Sail twins in this month as well.

– Mahindra Rexton W coming in this month.