As the 2 millionth car rolls off the production line of Maruti Suzuki in just a year, I feel like it is a great time to look back at what Maruti has done to the Indian car industry and take a step back and look at what they have done as a brand and a manufacturer.

It sounds funny to me to say that we don’t appreciate India’s largest PV manufacturer, but you, the car enthusiast, know exactly what I mean. While the common Indian man has voted with his wallet, the average car enthusiast does not really appreciate Maruti cars. Drawing taunts like ‘tin-can’ and ‘dabba’, these cars are not necessarily the sturdiest or the most fun to drive, both of which are major turn-offs for enthusiasts. I would know, because I was very much on the other side for a while!

However, to really appreciate what Maruti has built, we need to shift our perspective and see how Maruti operates and who they serve. They have built a rock-solid business over the years and have done a pretty solid job of changing with the market. Let us look at a few things that stood out to me about them.

The Product

Maruti cars are designed from the ground up with efficiency and ease of use in mind.

Firstly, ingress and egress are among the easiest things to do in Maruti cars. This is especially true for cars designed and built primarily for the Indian market, like WagonR and Brezza. The doors swing pretty wide open, are light, and are so easy to operate. There is almost always class-leading space on the inside for that particular segment. These may sound pretty basic, but Maruti nails these almost every time.

Maruti cars are meant to be dependable machines that give the best value for money to the Indian consumer. Mileage is the key driving factor behind this and Maruti has optimised their entire offering around it, leading to the famous ‘kitna deti hai’ phrase. Even today, Maruti cars are some of the most efficient in the segment. This economy is partly thanks to how light all of their cars are.

Maruti cars are almost always near the lighter end of the spectrum compared to their competitors. Even today, a Baleno weighs around 1 tonne, and an i20 weighs around 1.2. This 200 kg difference alone is significant, as a Baleno with 3 people in it will approximately be the same weight as an i20 with no one in it!

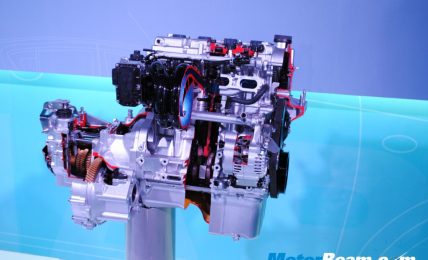

Even when it comes to technology they are selective of which ones to pursue, however they stay vigilant. Maruti was one of the first to bring a hybrid component to vehicles in the sub-10 lakh price range and is slowly adopting strong hybrid technology, starting with the Grand Vitara. While they are ahead in that aspect, they sure are taking their own time regarding EVs or ADAS.

This slow and measured approach also means that Maruti cars use tried and tested technology, and they produce some of the most reliable cars on the market, giving more peace of mind!

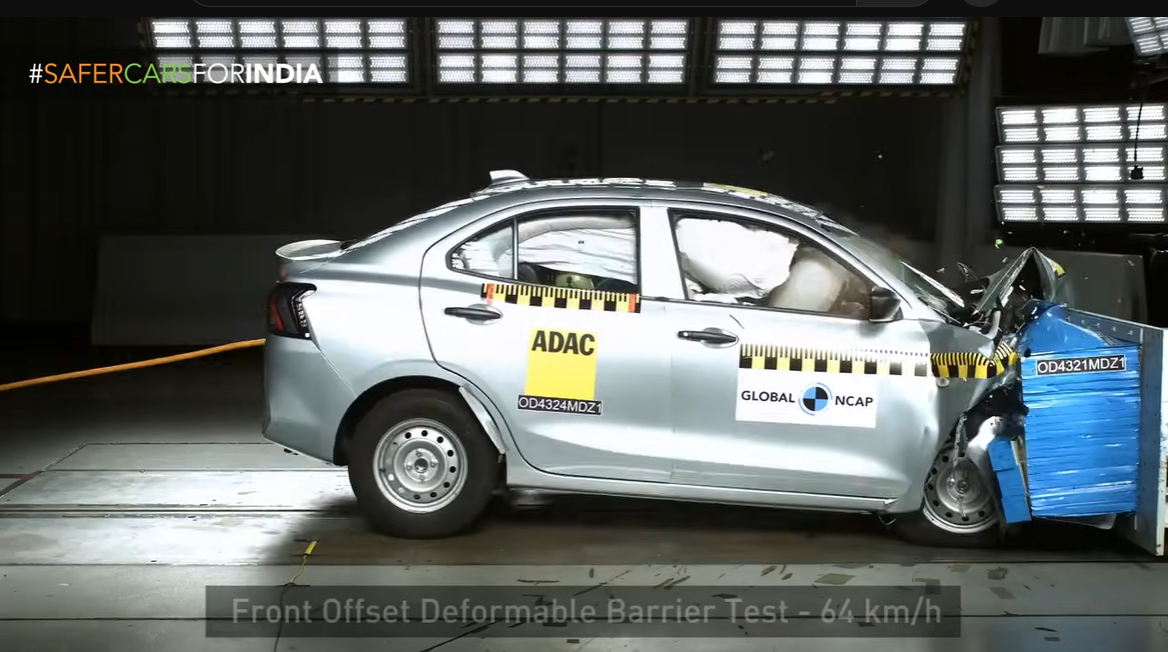

The sad aspect of Maruti’s ‘light at all costs’ philosophy is how much their cars lagged behind in safety.

The new Dzire clearly shows that they are capable of building a 5-star rated car that gives good economy, but most likely chose not to due to fuel economy reasons. I would love to know why Maruti held back for so long before doing this and was proven wrong about it being about the bottom line.

It is worth mentioning here about how Maruti utilises their JV with Suzuki quite well. Models like the Baleno and Swift are all IP of Suzuki Japan, and Maruti mostly focuses on localising them for the Indian market. Maruti really only developed the Vitara Brezza from the ground up and the Dzire using Swift’s platform.

Manufacturers like Ford struggled with this aspect quite a bit, as they primarily serve developed nations like the USA and Europe, meaning that they didn’t have many models they could just pick up and localise and drop into the Indian market. Toyota also struggles with this aspect, so they resort to badge engineering with extended warranty in India in the lower segments.

The Supply Chain

The automotive game is all about the supply chain. It is more hyper-local than what meets the eye!

Cars are inherently heavy, and so are their parts. This means that if you’re going to manufacture a car in a certain location, most of the heavy parts need to come from around the area. Any farther and the transportation costs add up, increasing the price of the final product!

So setting up a plant not only requires setting up the assembly line, employees, equipment, etc, but also setting up a whole network of suppliers within a particular radius that are willing to supply suspension components, steel, plastics, etc.

The scale of the task is pretty insane, and that is also possibly why you would see these plants bunched up together in locations like Pune, Chennai, etc. (Maybe it’s also easier to poach talent)

Contrast this with the smartphone industry, where you can ship silicon from pretty much anywhere across the world and assemble it in India, and you start understanding why there are so many smartphone competitors in India and so little new competition in the auto industry.

In the distribution side their network of dealers are the highest in the country. We all know that, but it really hit me when I saw a Maruti dealership on the way up the climb from Bagdogra, West Bengal, to Gangtok, Sikkim. It was a small one that could possibly keep one car on display, but nonetheless, there it was. I did not see another dealership of any brand for hundreds of kilometers!

With a network like that, Maruti reaches people others cannot reach. So it might not be surprising that Maruti cars sell really well even if they’re not the absolute best offering in that segment! It’s the same reason base model iPhones sell really well, even if they’re not the best offering for the price! They reach people with little to no idea about the market and what else they can buy for the same price!

Maruti, over the years, have built one of the strongest networks of suppliers and distributors. It’s not only the dealers, but they have figured out even the transportation of their cars to these dealers who are spread across the country. This kind of scale leads to a positive cycle.

When you know you will sell your cars in the millions, you bring an inherent upper hand to the negotiating table for raw materials. This, again, allows for the input costs to be cheaper for Maruti, which they pass on to the buyer.

The Strategy

For any brand, positioning is key. This is especially true with the automotive industry, which sells expensive depreciating assets. Car companies go to great lengths to shape their brand positioning to appeal to their target demographic more.

But what if the target starts shifting? That’s exactly what the Indian car market has been seeing over the past few years. As the share of younger buyers who are willing to spend more increases, Maruti’s appeal slowly started taking a hit. To respond ,Maruti came up with NEXA.

The decision to establish a whole new distribution channel through NEXA and give it its own cars has paid off incredibly well in hindsight for Maruti. I loved this decision so much that I talked about it 5 years ago here at MotorBeam!

The gist of it is that Maruti decided to go against launching a new brand altogether like Hyundai with Kia and just distribute their premium offerings and their low volume high margin cars like Jimny, S-Cross through Nexa. This separates the two major target customers for Maruti and allows them to keep everything else the exact same sans the distribution outlets for these cars.

You gotta give it to them for pulling this off. Honda is trying the same with their Big Wing line of showrooms, and it doesn’t seem to have been going too well compared to how fast Nexa scaled. I cannot imagine the assurances they would have had to give to the existing Maruti Suzuki (now called Arena) dealers that they wouldn’t be robbed of the good models because of Nexa!

Nexa also served as a vacuum for Maruti to let out their wacky side, with the Ignis and of course, the S Cross, which was a knee-jerk reaction to the Duster, EcoSport. That being said, even today, they make sure not to push their higher-end offerings too high price-wise and ensure that almost all their models, premium or not, remain high-volume.

I feel they are still trying to break the younger market, perhaps a little too hard sometimes. (What is city-bred hot new techy Brezza even supposed to mean xD)

View from the top

While we don’t necessarily need to agree with the philosophy of the Maruti cars, I really have grown to appreciate and respect their grind and what they have built in India.

Readers who trade in the Indian stock market know how reliable and well-regarded a stock Maruti Suzuki is. At the end of the day, they’re a business and a very well-run one at that. They know their customers, their network and take a slow and measured approach at every step, making sure not to fall into any cash traps that might affect their bottom line or the ex-showroom price of their products.

They have made good strategic calls at crucial market crossroads and keep rolling out more and more cars by the day! Even as they enter the EV market quite late, I am pretty sure they will leverage what they already know through their experience strong hybrids, and will produce a reliable car, and will utilise their expansive supply chain to get their offering to the ends of India. This is what they’ve been doing and I don’t see any reason why they would do anything different!

Now, dear Maruti, just make all your cars as safe as your new Dzire, so nearly 42% of India can drive that much safer!